A formula that Graham intended as a warning, V = EPS x (8.5 + 2g), is very popular today due to an omission in recent editions of The Intelligent Investor.

Introduction

There is a surprisingly common misconception that Graham recommended investing in stocks using the formula:

V = EPS x (8.5 + 2g), or

Value = Current (Normal) Earnings x (8.5 plus twice the expected annual growth rate)

A quick online search for "Benjamin Graham Formula" will bring up dozens of analysts, websites and stock screeners recommending stocks using this wrong formula. In fact, it is more popular than the actual 17 calculations given by Graham for stock selection, probably because it is easier to use.

What Graham Actually Wrote

Graham was completely against any kind of Charting/Technical Analysis/Forecasting. He always analyzed stocks based on past performance and wrote entire chapters on stock selection. This formula is not mentioned anywhere in them.

He only mentions this formula to show how unrealistic the market's growth expectations are, when seen retrospectively.

A few paragraphs after mentioning this formula, he writes:

"Warning: This material is supplied for illustrative purposes only, and because of the inescapable necessity in security analysis to project the future growth rate for most companies studied. Let the reader not be misled into thinking that such projections have any high degree of reliability or, conversely, that future prices can be counted on to behave accordingly as the prophecies are realized, surpassed, or disappointed."

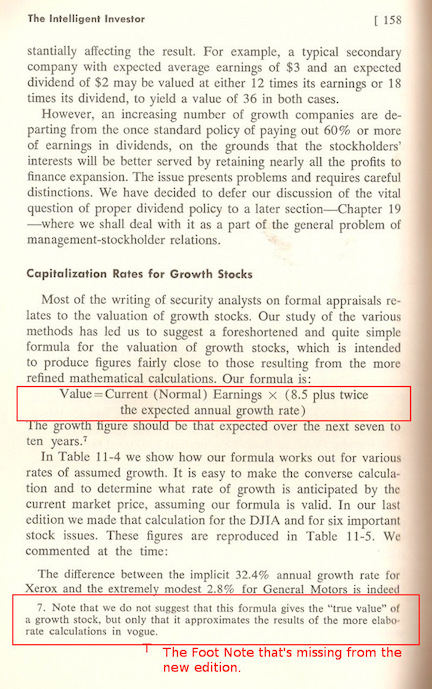

There is even a footnote in the original 1973 edition of The Intelligent Investor (click on the image to see a scan) to clarify that this equation does really give any "true value."

This footnote is missing in more recent editions of the book (it's now in the "Endnotes" section which is possibly the cause of the confusion). But the warning is present in the new editions too.

The Irony

The irony of this entire story is that the very formula with which Graham meant to show how unreliable market forecasts and earnings forecasts were, is the formula recommended the most today as the "Benjamin Graham Formula"!

There is perhaps good reason why Graham's protege and most famous student, Warren Buffett, said:

"Beware of geeks bearing formulas."

A more comprehensive article about this formula — with additional screenshots comparing the two editions — is now available at Understanding The Benjamin Graham Formula Correctly.

Watch Video

Submitted by GrahamValue. Created on Friday 4th November 2011. Updated on Wednesday 29th January 2025.

Comments

Growth rate

The problem here is selecting the expected growth rate. The problem with the future is that it has not happened yet. So you can be way off with selecting a growth rate to plug in. This is a big problem for privately held companies that are not publicly traded. How do you establish a stock value for the private investors. My current employer is employee owned. They have a formula for establishing the quarterly trade price. But the formula usually results in many more sales than purchases. So the company ends up buying back stock.

Spot on

Absolutely, Northewest Bob!

In his book, Graham uses this formula to replicate other forecasting methods; while retrospectively showing how stocks never behave according to any such forecasts. As seen above, he gives multiple warnings to never use any such formula.

And yet, this is the most commonly recommended Benjamin Graham method today.

To quote Graham again:

Update

Buffett's and Graham's remarks on the futility of financial projections can be seen at — Security Analysis - Projected Revenue or Past Earnings?

Graham Formula

I've read the 1949 edition of The Intelligent Investor & am going through the 1951 Edition ( 3 rd) of Security analysis, I've not come across the said formula in the Intelligent investor & not in security analysis so far. What edition of those books were you referring to.

Thank You

A more comprehensive article

Dear BRMR,

The formula is present both in the last edition of The Intelligent Investor written by Graham in 1973, as well as the recently released edition that was updated with commentary by Jason Zweig.

A more comprehensive article about this formula — with additional screenshots comparing the two editions — is now available at Understanding The Benjamin Graham Formula Correctly.

Thanks a lot for pointing

Thanks a lot for pointing this out. I read this chapter just yesterday, I ignored the endnote and misunderstood that this formula was the recommended method for deriving the intrinsic value. Wonder what losses I would have incurred had it not been for this article!!

A more detailed analysis

Glad to be of help, Rajiv!

For a more detailed analysis of this issue, please see Understanding The Benjamin Graham Formula Correctly.

Thank you.

The Graham Formula

The Equation quoted above was first presented by Graham in the 4th 1962 Edition of Security Analysis, Principles and Technique in what has been termed the Lost Chapter of Security Analysis, on pages 537-538.

This chapter is reproduced in its entity in

'Benjamin Graham and the Power of Growth Stocks: Lost Growth Stock Strategies from the Father of Value Investing' by Frederick K. Martin, Nick Hansen, Scott Link, and Rob Nicoski.

Martin writes,

'A ... flaw has to do with the potential competition from high interest rates. Should the P/E ratio of stocks be immune to high interest rates? Of course not. Graham himself addressed this issue when he suggested that P/E ratios should be adjusted downward if long-term interest rates on corporate bonds exceeded 4.4 percent. Graham picked 4.4 percent because the AAA

corporate rate averaged 4.4 percent in 1964. He introduced his revised formula at a seminar sponsored jointly by the Institute of Chartered Financial Analysts and the Financial Analysts Research Foundation, held on September 18, 1974, in New York City.'

The 4th 1962 Edition of Security Analysis, Principles and Technique had been greatly revised in the light of the BUBBLE MARKET up to 1961, with revisions throughout the Common Stock Analysis Section, culminating in the ‘Lost Chapter’, Chapter 39 on valuing Growth Stocks.

The Preface of the 4th. Edition states,

“The three previous editions of Security Analysis were published in 1934, 1940, and 1951. Like this (the 4th.) volume, they dealt with three main topics: (1) the orderly, comprehensive, and critical analysis of a company's income account and balance sheet; (2) the formulation of appropriate criteria for the selection of well-protected bonds and preferred stocks, and (3) approaches to the selection of common stocks for investment purposes. It does not seem to us that the first two divisions present any new difficulties of great magnitude, or require significant changes in our handling of them. But we cannot say the same about common-stock investment.

[truncated]

Our title page notes the advent of the new principal author, Sydney Cottle, who has taken a major part of the work of revision from the shoulders of its original authors. We are happy to retain the collaboration of Charles Tatham, who is responsible for the chapters on public utility analysis and his rendered other aid. We acknowledge with deep thanks for physical help and kind indulgence accorded by Stamford Research Institute, which has granted Dr. Cottle leave from his institute duties. Others, who helped with former additions, are remembered with gratitude.

The preface to the 1951 edition closed with the following paragraph:

"Our final word is addressed to the student – reader who may be planning to make security analysis his calling, and to whom we have ventured to dedicate this third edition. Security analysis is on the verge of attaining some measure of formal recognition as a professional discipline. It will demand better training and more rigorous thinking from its members than it has done in the past. We think it offers rewards fully commensurate with its demands and responsibilities. The "average" analyst will probably fare about the same as the average member of any other profession. But for the outstanding man - Who combines native ability, a flair for the subject, and courageous, independent spirit – the sky is the limit."

Since 1951 a profession has made great strides in numbers, capabilities, and influence. We wish it even greater success in the years ahead.

Benjamin Graham

David L Dodd

Sidney Cottle

Charles Tatham

Footnote: We ask the reader to bear in mind that our manuscript was virtually completed and this preface drafted toward the end of 1961, when prevailing sentiment was in strong disagreement with our conservative position.”

Note: The 6th. 2009 and 7th. 2024 Editions are reproductions of the 2nd. 1940 Edition, which as stated in the prefaces of the 3rd. 1951 and 4th. 1962 Editions was completely obsolete.

Buffett Recommends The 2nd (1940) Edition

Dear Tkydon,

Thank you for your comment!

The Preface portion of your comment had to be truncated to avoid copyright issues with the publishers. Interested readers can look up the complete text of the Preface in the book (links to all editions are given in the second link below).

Also, your other comment on this article — which was a duplicate of the one posted on Understanding The Benjamin Graham Formula Correctly — has been removed from here and will be responded to over there.

To begin with, please note that the version of Security Analysis that Buffett actually recommends is the second edition.

The Updated Intrinsic Value Formula has been discussed in detail as well, and is linked to from the other article above that you have commented on.

All the footnotes and warnings about this formula shown here are from Graham's own original editions, some of which are missing in newer editions.

Third party quotes and interpretations of Graham, and other Value Investing topics, are notoriously inaccurate.

Thank you again for your comment!