The Net Current Asset Value (or Net-Net) strategy of Benjamin Graham — Warren Buffett's mentor — is the most misused technique in his Value Investing framework today.

Net Current Asset Value

The NCAV technique of stock evaluation is one of the most well-known strategies in Graham's Value Investing framework, but actually included criteria for Earnings and Diversification.

NCAV Rules

The rules Graham specified for NCAV stocks were as follows.

[1.] A diversified group of common stocks at a price less than the applicable net current assets alone — after deducting all prior claims, and counting as zero the fixed and other assets.

[2.] Eliminated those which had reported net losses in the last 12-month period.

Diversification Rules

Graham also recommended a portfolio size of 30 for NCAV stocks; or in other words, not more than 3.3% of one's portfolio per NCAV stock.

"30 issues at a price less than their net-current-asset value."

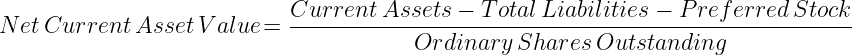

NCAV Calculation

Graham's instructions above yield the following straightforward Intrinsic Value calculation for NCAV stocks.

Note: GrahamValue deducts Preferred Stock (both Redeemable and Non-Redeemable) in its NCAV calculation.

Why Total Liabilities?

Net Current Assets (or Working Capital) is defined as Current Assets minus Current Liabilities. This is the generally accepted definition; and is even mentioned in Graham's own book, The Interpretation of Financial Statements.

For NCAV stocks however, Graham specifically mentions "after deducting all prior claims... fixed and other assets". This is the reason Total Liabilities are used to identify NCAV stocks, both on GrahamValue and elsewhere.

Positive EPS (TTM)

EPS (TTM) is a common abbreviation for Trailing 12-month Earnings Per Share. Incidentally, Graham's instruction here to exclude stocks without a positive EPS (TTM) is also the only non-annual data point in his investing framework.

NCAV ≠ Just Bargains

Regrettably, the two critical requirements above that Graham included for NCAV stocks — for a positive EPS (TTM) and for limiting capital allocation to 3.3% per stock — are just more Graham principles that are rarely followed today.

Misapplication of the NCAV strategy is therefore perhaps the primary cause for Graham's timeless methods now being mistaken for bargain hunting.

"While some might mistakenly consider value investing a mechanical tool for identifying bargains, it is actually a comprehensive investment philosophy that emphasizes the need to perform in-depth fundamental analysis, pursue long-term investment results, limit risk, and resist crowd psychology."

Finding NCAV Stocks

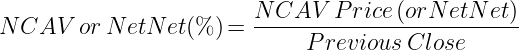

NCAV or Net-Net(%)

GrahamValue's screeners support NCAV or Net-Net(%) ≥ (greater than or equal to) filters because — by definition — the higher a stock's NCAV Price (Net-Net) in relation to the price, the better.

An NCAV or Net-Net(%) of 100% or more on GrahamValue's screeners therefore indicates that the stock's NCAV Price (Net-Net) exceeds its current market price.

Graham Screeners

The Preset Links below can be used to open the free Classic Graham Screener and the paid Advanced Graham Screener with the NCAV grade — which includes a positive EPS (TTM) requirement — preselected.

Two-Thirds NCAV

One can also find stocks exceeding Graham's requirements, such as two-thirds NCAV (Net-Net), using the above Benjamin Graham stock screeners.

Cigar Butts

There is no reference to the "cigar butt" approach in Graham's own books. Buffett does refer to it in his 1989 Letter to Shareholders, but he doesn't include any specific definition for such stocks; other than that they would be characterized by a low market price.

"If you buy a stock at a sufficiently low price, there will usually be some hiccup in the fortunes of the business that gives you a chance to unload at a decent profit, even though the long-term performance of the business may be terrible. I call this the "cigar butt" approach to investing. A cigar butt found on the street that has only one puff left in it may not offer much of a smoke, but the "bargain purchase" will make that puff all profit."

Below Working Capital

In the following video — which comprises of two clips from the 2003 and 1998 Berkshire Hathaway Annual Shareholder Meetings respectively — Buffett defines a "cigar butt" stock as one "selling well below working capital", which is a little different from Graham's definition of NCAV stocks.

Buffett also says here that the "cigar butt" approach works well on a small scale, and that Berkshire Hathaway itself was one. Buffett has repeated, on multiple occasions over the years, that one of the main reasons Berkshire Hathaway moved towards more qualitative investing was because the "cigar butt" approach — despite being effective — did not scale to the kind of figures they had to work with; especially in their later years.

Watch Video

Submitted by GrahamValue. Created on Monday 18th May 2020. Updated on Wednesday 29th January 2025.