Summary

- Graham designed an elaborate stock selection framework for investors. V = EPS x (8.5 + 2g) is not part of the framework, and is only mentioned briefly to demonstrate that growth rate projections are almost never reliable.

- Graham gave two warnings with this formula. But due to an omission in recent editions of The Intelligent Investor, this formula is often mistakenly used for stock valuation today.

- Graham's real framework is far more comprehensive and well-balanced. The seventeen rules in the framework ensure both a qualitative and a quantitative Margin of Safety in one's investments.

Introduction

Benjamin Graham — also known as The Dean of Wall Street and The Father of Value Investing — was a scholar and financial analyst who mentored legendary investors such as Warren Buffett, William J. Ruane, Irving Kahn and Walter J. Schloss.

Warren Buffett once gave a talk explaining how Graham's record of creating exceptional investors (such as Buffett himself) is unquestionable, and how Graham's principles are everlasting. The talk is now called The Superinvestors of Graham-and-Doddsville [PDF].

Buffett describes Graham's book The Intelligent Investor (in its preface) as "by far the best book about investing ever written".

Graham's Value Investing Framework

Graham dedicates two entire chapters of The Intelligent Investor to his stock selection framework (which he first introduced in Security Analysis).

Chapter 14: Stock Selection for the Defensive Investor

Chapter 15: Stock Selection for the Enterprising Investor

In these chapters, Graham recommends three different categories of stocks — Defensive, Enterprising and NCAV — and seventeen qualitative and quantitative rules for identifying them.

Defensive, Enterprising and NCAV stocks can be reliably detected by today's data-mining software, and offer a great avenue for accurate automated analysis and profitable investment. The seventeen rules for these stocks ensure both a qualitative and a quantitative Margin of Safety when investing in them.

The Misunderstood Intrinsic Value Formula

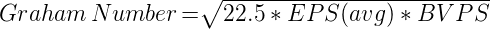

Graham specifies three different intrinsic Value calculations — the Graham Number, the Enterprising price calculation and the NCAV — in his framework, with supporting qualitative rules for each.

But the intrinsic value calculation most attributed to Graham today is called the Benjamin Graham Formula, and is usually some variation of the following:

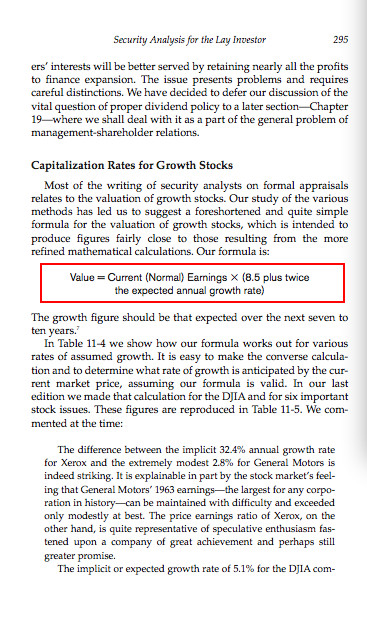

V = EPS x (8.5 + 2g), or

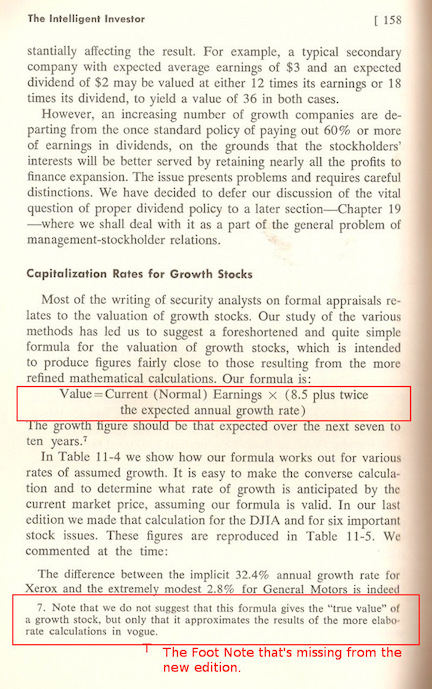

Value = Current (Normal) Earnings x (8.5 plus twice the expected annual growth rate)

Graham only mentions this formula briefly — in an unrelated chapter of The Intelligent Investor — to demonstrate why the market's growth expectations are rarely justified. This formula is not mentioned in the stock selection chapters, has no supporting qualitative checks, and is followed by two clear warnings.

Warning 1

The first is a footnote that says that this formula does not give any real intrinsic value for a stock.

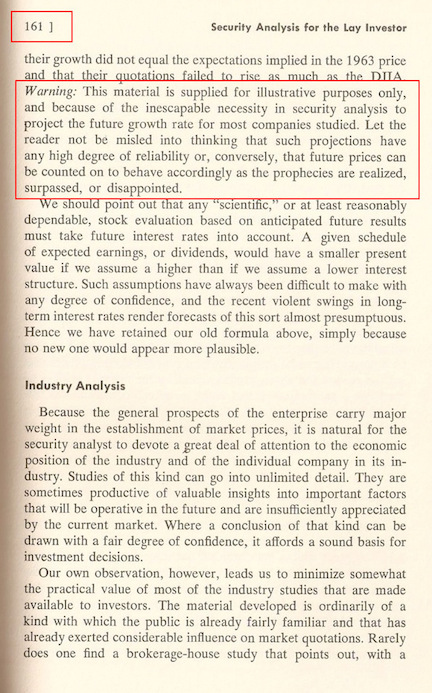

Warning 2

The second warning — clearly labeled as such — then says that the formula is only intended as an illustration, and that such projections of growth rates are never reliable.

The stock selection chapters have no such warnings, and Graham clearly recommends the more comprehensive framework described in them.

How The Misunderstanding Started

What seems to have started the misunderstanding is that the most commonly available edition of the book today is not the one originally written by Graham, but the new one with commentary by Jason Zweig.

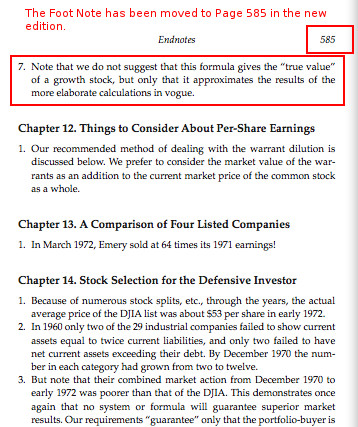

In this edition, all the Foot Notes from the original book have been moved to the end of the book (Endnotes) to make place for Zweig's commentary.

For example, if we look at the page with the formula in the new edition, we see that the footnote — where Graham cautions against using this formula for intrinsic values — is now missing.

In the new edition, the footnote is now at the end of the book — on Page 585 — where no one is likely to see it.

This missing footnote is probably what has led to current misunderstandings about the formula. The full warning (second scan above) is only given a couple of pages later, and is easy to miss.

The Updated Intrinsic Value Formula

The formula discussed above is the one that was actually published by Graham.

But several analysts also refer to the following as Graham's updated Intrinsic Value formula:

V = {EPS x (8.5 + 2g) x 4.4} / Y

where:

Y: the current yield on 20 year AAA corporate bonds.

This update is simply a passing reference that Graham supposedly made in a later interview, of how one might account for interest rates. All the warnings that were given with the original formula would apply here too.

In fact, Graham expresses several misgivings with the updated version as well in the said interview (The Decade 1965-1974: Its significance for Financial Analysts).

Other Warning Signs

1. "Expected" Growth Rate

Graham wrote extensively about the unreliability of forecasts in finance. So the term "Expected Growth Rate" should ring alarm bells for any true student of Graham.

In fact, in the same chapter in which this formula is mentioned, Graham also writes the following about earnings forecasts.

"It appears to be almost impossible to distinguish in advance between those individual forecasts which can be relied upon and those which are subject to a large chance of error."

Buffett too scoffs at the idea of making investment decisions based on earnings forecasts and projections.

"If you have a business that fits the following criteria, call me or, preferably, write... (2) demonstrated consistent earning power (future projections are of little interest to us, nor are "turnaround" situations)."

Graham's actual framework only uses objective figures from the past — including checks for past growth rates — and requires no assumptions about the future.

But this formula uncharacteristically requires an "expected annual growth rate" — a subjective assumption — to arrive at an intrinsic value.

If we look at how this formula is actually used in the book (or in the scans given here), Graham uses this formula to calculate growth rates expected in the past — from past stock prices — and demonstrates how such expectations of growth are rarely justified.

2. Missing Assets Condition

Every set of rules in Graham's real framework also includes a check for assets. This formula has no such checks.

For example, the Graham Number — the price calculation for Defensive quality stocks — is calculated as:

Services and other asset-light companies were common in Graham's time. In a calculation such as the above, lower assets can be offset by higher earnings and vice versa.

Graham designed a comprehensive, well-balanced framework that could assess all types of companies.

On the other hand, the V = EPS x (8.5 + 2g) formula is only useful for studying past misjudgments of growth expectations by the market. It cannot be used to calculate present intrinsic values, or to predict future growth rates.

Note: The 11th factor in Walter Schloss' 16 Factors too advises investors to buy assets at a discount rather than buy earnings.

Keeping It Simple

"Beware of geeks bearing formulas."

There are those who will continue to recommend stocks using variations of the V = EPS x (8.5 + 2g) formula. They will defend it by saying that valuation is an art, that an intrinsic value is only an estimate, and that such warnings apply to all methods of valuation.

George Soros' Theory of Reflexivity states that our perception of the world is inherently flawed. The Theory of Reflexivity is also a direct repudiation of the Efficient Market Hypothesis (EMH) which states that stock markets are efficient; a hypothesis that Buffett too refuted in The Superinvestors of Graham-and-Doddsville.

But while our view of reality may not be perfect, those of us with more clarity tend to make slightly better decisions; and success in investing depends on our ability to make fewer mistakes (maintain a Margin of Safety), and to make better decisions based on hard facts.

The facts about Graham's methods are all laid out in plain view above. When having to decide between the methods Graham recommended and the methods he warned against, it may help to remember Buffett's Keep It Simple principle. The simple fact is that Graham only made a passing reference to this particular formula — with two warnings — while dedicating two whole chapters to his actual stock selection framework.

A popular Intrinsic Value calculation that's actually in Graham's framework, is the Graham Number.

Video: Ben Graham Formula

Buffett: Projections are Nonsense

At the 1995 Berkshire Hathaway Annual Shareholder Meeting, Warren Buffett and Charlie Munger describe Financial Projections as "Fatuous" and "Total Nonsense"; and say that they deliberately avoid looking at them.

Facebook Likes and Comments

Submitted by GrahamValue. Created on Monday 27th April 2015. Updated on Wednesday 29th January 2025.

Comments

Benjamin Graham proposed investing in CTR

The year is extremely important. Without it, there is no comprehension of the context.

You did not answer any of my questions.

You did not answer any of my questions.

Which Book?

Which Edition?

Where does the 8.5 come from?

The figure 8.5 represents the

The figure 8.5 represents the base value of a business in Graham’s view before accounting for any growth. It is the price an investor pays to obtain current earnings only, under the assumption that these earnings will remain constant, with no increase or decrease in the future.

The 8.5 figure (the zero-growth multiple) is the cornerstone of the formula and represents the fair price-to-earnings (P/E) multiple for a company that achieves no growth whatsoever (0% growth).

The 8% threshold: Graham warned that this formula becomes unreliable if the expected growth rate exceeds 8% per year, because in such cases the mathematical assumptions become unrealistic and overly sensitive.

The book referenced is the fourth revised edition, published in 1973, which is the final version personally reviewed by Benjamin Graham before his death.

You have not answered the Question.

But where does the 8.5 come from? How to calculate it? How would you change it, if it needed to be changed?

"The figure 8.5 represents the base value of a business in Graham’s view before accounting for any growth"

No. Nothing to do with "Graham's view"...

"The book referenced is the fourth revised edition, published in 1973, which is the final version personally reviewed by Benjamin Graham before his death."

Oh, The Intelligent Investor... ? You're looking at the wrong book!

Correction

Dear Omar_H,

Graham warns that all such formulas are unreliable.

Dear Tkydon,

All editions are specified — with screenshots — in the article.

Thank you again for your comments!

The Formula is incomplete and the brackets are in the wrong plac

Intrinsic P/E Ratio = 8.5 + 2g x 4.4/Y

g = Projected Average Growth Rate

4.4 = was the prevailing AAA Corporate Bond Yield at the time

Y = the current AAA Corporate Bond Yield

Therefore, 4.4/Y adjusts the P/E ratio based on g for the current prevailing Interest Rate environment. (Just like Bonds, if interest rates go up, you would expect Bond Prices and Stock Prices to go down)

The Current Yield of AAA Corporate Debt is about 4.4%, so this currently cancels to 1...

The Intrinsic Stock Price = EPS x (8.5 + 2g x 4.4/Y) + Liquid Current Assets Not used in Production - Short-Term Liabilities

Taking into account the Assets or Liabilities on the Balance Sheet that are not contributing in any way to the EPS or increase in g

But, you still didn't explain the 8.5...

Detailed Responses

Dear Tkydon,

Thank you for your comment!

Please see detailed responses below.

Graham explains in the book (screenshot in the article above) that it's an example meant to demonstrate that such formulas don't work.

It's the more modern of the Graham's books and all screenshots are included from both original and modified editions.

Absolutely.

The exact formulas are given in the stock selection chapters.

These formulas require no assumptions, about future growth rates or anything else.

Agreed.

Which is also a discarded Graham method.

Very true - True Value Investing Includes Quality And Growth

Yes.

The more recent of his books which specifically warns readers not to use such oversimplified formulas, and has two whole chapters on stock selection instead. Screenshots in article above.

1. Benjamin Graham's Updated Intrinsic Value Formula

2. Recommended Edition of The Intelligent Investor

3. Recommended Edition of Security Analysis

Please see the above links, as well as the others given in the article.

This article is more than a decade old and all your points have been discussed several times over in the article.

Please read the article completely and the the related links for detailed explanations.

Thank you again for your comments!

So you don't know where the 8.5 comes from...!!!

So you don't know where the 8.5 comes from...!!!

Graham did not magically conjure it out of a Magician's Top Hat!

Your homework assignment, should you choose to accept it, is to find out where it comes from!

I reject your answer

"

The S&P500, whilst being the 503 US Stocks, (Index Fund) has its own Price and its own P/E Ratio, and should command its own Margin of Safety... I would refer to the Shiller CAPE.

In 2001, its diversity didn't help you...

Which is also a discarded Graham method."

You clearly do not Understand!

I suggest you read the chapters on Mr. Market again.

Spam

Dear Tkydon,

The 8.5 is irrelevant when there are so many warnings given against using such oversimplified formulas.

Your responses are becoming repetitive and disrespectful.

Please comment only if you have something genuine to contribute to the discussion.

Thank you!