Customizing the seventeen-rule framework of Benjamin Graham — Warren Buffett's mentor — for non-U.S. currencies, Interest Rates and Inflation.

United Kingdom

Although Graham's framework comprises primarily of ratios that are self-calibrating, there are a few region-specific parameters that may need to be customized if one is investing in countries other than the United States.

Shown below is one such customization using the currency conversion rates, Interest Rates and Consumer Price Index (CPI) values of the United Kingdom.

A point of interest here as well, is that Graham was British-born.

1. Size in Sales

The first region-specific parameter in Graham's framework is the Size rating.

Graham recommended a minimum Sales figure of $100 million for Defensive grade stocks, which works out to $700 million in 2022 based on the increase in CPI in the United States.

Since the Pound Sterling (GBP) is worth roughly 1.21 times the United States Dollar (USD) as of 2022, and since GrahamValue lists values for U.K. stocks in GBP, the Sales rating will simply need to be reduced by 1.21 times to screen for Defensive grade U.K. stocks.

140% ÷ 1.21 = 115%

700M ÷ 1.21 = 578M

This yields a Sales figures of £578 million, which corresponds to the $700 million required for a U.S. stock. Rounding up yields a Size in Sales filter value of 120%. A Size in Sales filter value of 120% yields a Sales figures of £600 million.

Size in Sales = 120%

1a. Size in Assets

For Public-Utilities and Financial Enterprises in the U.S., Graham recommended a Total Assets figure of $50 million which works out to $350 million today.

A similar calculation yields a Size in Assets filter value of 120%. A Size in Assets filter value of 120% yields a Total Assets figures of £300 million, which corresponds to the $350 million required for U.S. stocks.

Size in Assets = 120%

2. Earnings Growth

An Earnings Growth rating of 100% on GrahamValue corresponds to an actual averaged earnings growth of 33% over the past ten years, just as Graham recommended for U.S. stocks.

Since the change in CPI in the U.K. over the decade 2012-2022 is almost identical to the U.S. number — 25% — this rating requires the same adjustment in the U.K. today as in the U.S.

The CPI data required is available on the Office for National Statistics, and is discussed in more detail on the Forum.

Earnings Growth = 75%

3. Intrinsic Value

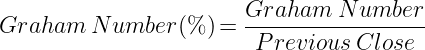

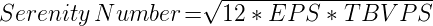

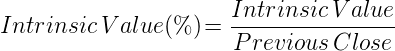

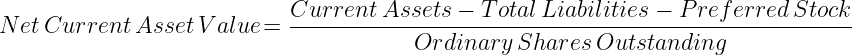

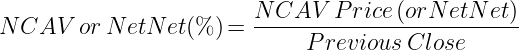

Intrinsic Value is the price corresponding to a stock's Graham Grade: Defensive, Enterprising or NCAV (Net-Net).

a. Defensive

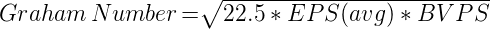

The Intrinsic Value of a Defensive grade stock is the same as its Graham Number.

A Graham Number(%) of 60% on GrahamValue corresponds to the 10-year AA Corporate Bond Yield of 2.16% in the U.S. as of January 2022.

Since Bond Yields in the U.K. are close to 2.21% in July 2022, this too allows for a P/E ratio of up to 45. The Graham Number of a stock would need to be multiplied by 1.73 to adjust it to a P/E of 45. This corresponds to a minimum Graham Number(%) of 58% on GrahamValue, which can be rounded up to 60%.

Graham Number(%) = 60%

b. Enterprising

Enterprising grade stocks too would need to have their Intrinsic Value(%) adjusted similarly, as both calculations are based on similar principles.

Intrinsic Value(%) = 60%

c. NCAV (Net-Net)

NCAV figures are calculated based on asset values alone, and so NCAV (Net-Net) grade stocks do not require having their Intrinsic Value(%) adjusted.

NCAV or Net-Net(%) = 100%

Screening

The below links will open the Classic Graham Screener (free) and Advanced Graham Screener (paid) with all U.K. exchanges selected. The Advanced Graham Screener will have the adjusted parameters discussed above selected as well.

Currencies

GrahamValue gets all its Price Data and Fundamental Data from its data provider, and is designed to err on the side of caution. The Currency Codes for the Price Data and Fundamental Data of a stock are usually identical.

GBP / GBp

U.K. stocks are often traded in GBX (or GBp) while their fundamentals are reported in GBP. GrahamValue takes care of this 100x conversion.

For any other discrepancies between the Currency Codes of the Price Data and Fundamental Data, the stock's Previous Close is marked Zero; so as to prevent it from being accidentally cleared on GrahamValue's screeners.

Please note that while Graham cautions investors about foreign stocks and ADRs, he does not recommend against investing in non-U.S. economies.

Regional Distribution

Use the filters below to see how many stocks with Intrinsic Values exceeding 70% are available across countries and exchanges.

These lists only include analyses with Fiscal Years in the current or previous years. Older analyses are not counted.

Utilities and Financials

| Graham Grade | Stocks |

|---|---|

| Defensive | 1,368 |

Industrials and Other

| Graham Grade | Stocks |

|---|---|

| Defensive | 569 |

| Enterprising | 2,134 |

| NCAV (Net-Net) | 1,459 |

Watch Video

Warren Buffett

Warren Buffett explains how, all else being equal, the location of a company does not affect the evaluation of its investment worthiness. The same framework can applied across countries and regions.

Submitted by GrahamValue. Created on Thursday 16th May 2019. Updated on Wednesday 29th January 2025.

Comments

Italy value

Hi! Can you explain with an example how to adjust this value for italian Stock?

Thanks!

Screener Filters for Italy in 2024

Dear Andrea Viola,

Thank you for your comment!

As a quick example, we will use the following values while screening for Italian stocks.

US CPI change from 1971: 775%

US Dollar to Euro: 0.93

Italy CPI change from 2014: 120%

Italy 10 Year Bond Yield: 3.882%

Please note that Inflation in Italy since 1971 (1200%) is higher than in the US (700%), but this factor should already have been compensated for by the Currency Conversion rates and so should not be required to be considered here.

The above values will yield the following Filter values on GrahamValue's screeners.

Size in Sales: 144%

Size in Assets: 144%

Earnings Growth: 61%

Intrinsic Value(%): 76%

As mentioned above, the Intrinsic Value adjustment is for Defensive and Enterprising grade stocks alone.

Please note that these values have been obtained online, and have not been verified.

Thank you again for your comment!

Dear,

Dear,

Thank you for your reply.

Why Sales and Assets should be same?

Size in Sales: 144%

Size in Assets: 144%

Thanks!

Calibration

Dear Andrea Viola,

The filters for Company Size have been designed or calibrated to work identically. Please the link in the previous comment for a detailed explanation.

Thank you for your comment!

Italy CPI

Sorry for the question but i'm really interessed to buy your monthly plan.

Why you use CPI from 2014 and not from 1971 too in Italy?

https://www.infodata.ilsole24ore.com/2016/05/17/calcola-potere-dacquisto-lire-ed-euro-dal-1860-2015/

Because is 1712% rate..

Thanks

Different Calculations

Dear Andrea Viola,

The two Inflation rates are for two different calculations. Please see the links above, or the Video Tutorials.

Thank you for your comment!

the last question, I promise

Graham explains that he uses corporate bonds, isn't the value you used just for Italian government bonds?

Questions Welcome

Dear Andrea Viola,

Thank you for your comment!

You're right. Graham did refer to corporate AA yields. The assumption here is that Government bonds tend to have lower risk and lower yields. So the actual filter values would be less restrictive.

However, as mentioned, this was just a quick unverified example. Actual regional customisations are best done by investors themselves, as they would know their own regions best.

For example, Middle-Eastern countries tend to not have bond yields at all.

All your questions are welcome. Thank you again for your comment!

Bias

Does the comparison of intrinsic values and percentages across different countries reveal any biases towards those with lower currency values, potentially due to their numerically larger figures? How does GrahamValue.com adjust for or interpret these differences?

Size Metrics

Dear iamro,

Thank you for your comment!

As mentioned above, Graham's metrics comprises primarily of ratios that are self-calibrating. The two Size metrics are the only ones that need to be adjusted for currency conversion rates, and are discussed above as well.

The Quick Reference and its Video Tutorials discuss all of the above in full detail.

Thank you again for your comment!