Benjamin Graham was Warren Buffett's professor and mentor at Columbia Business School. Buffett even named his son, Howard Graham Buffett, after Graham. In the preface to Graham's book - The Intelligent Investor - Buffett calls it "by far the best book about investing ever written."

GrahamValue's Benjamin Graham Screener applies Graham's 17 financial criteria to all 4700 NYSE and NASDAQ stocks to find Defensive, Enterprising and NCAV grade Graham stocks. Today, we will do a complete Graham analysis for Yahoo! Inc. (YHOO) and see what grade and price Graham would have recommended for it.

Please note that Yahoo! Inc was acquired by Verizon Communications Inc (VZ) in 2017.

Yahoo! Inc. is an American multinational internet corporation headquartered in Sunnyvale, California. It is one of the most popular websites in the United States. Yahoo! Inc. was founded by Jerry Yang and David Filo in January 1994 and was incorporated on March 1, 1995.

1. A Defensive Analysis:

The first grade of stocks recommended by Graham are called Defensive stocks. The criteria that Graham specified for identifying Defensive stocks are as follows:

Summarized from CHAPTER 14 of The Intelligent Investor - Stock Selection for the Defensive Investor:

1. Not less than $100 million of annual sales.

[Note: This works out to $500 million today based on the difference in CPI/Inflation from 1971]

2-A. Current assets should be at least twice current liabilities.

2-B. Long-term debt should not exceed the net current assets.

3. Some earnings for the common stock in each of the past ten years.

4. Uninterrupted [dividend] payments for at least the past 20 years.

5. A minimum increase of at least one-third in per-share earnings in the past ten years.

6. Current price should not be more than 15 times average earnings.

7. Current price should not be more than 1-1⁄2 times the book value.

As a rule of thumb we suggest that the product of the multiplier times the ratio of price to book value should not exceed 22.5.

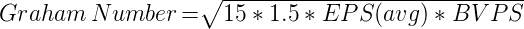

Graham's recommended price for Defensive stocks, popularly known as the Graham number, can be calculated from criteria #6 and #7 as:

The publicly available financial figures for Yahoo! Inc. are as follows:

Annual Sales | $4,990.00 Million | Reported Book Value | $12.76 |

Current Assets | $5,652.71 Million | Tangible Book Value | $9.49 |

Goodwill | $3,826.75 Million | EPS - Current | $3.45 |

Intangibles | $153.97 Million | EPS - Last Year | $0.82 |

Total Assets | $17,103.25 Million | EPS - 2 Years Ago | $0.90 |

Current Liabilities | $1,290.23 Million | EPS - 3 Years Ago | $0.42 |

Long Term Debt | $0.04 Million | EPS - 4 Years Ago | $0.29 |

Total Liabilities | $2,543.05 Million | EPS - 5 Years Ago | $0.47 |

Redeemable Preferred Stock | $0.00 Million | EPS - 6 Years Ago | $0.52 |

Non-Redeemable Preferred Stock | $0.00 Million | EPS - 7 Years Ago | $1.28 |

Shares Outstanding | 1,115.23 Million | EPS - 8 Years Ago | $0.58 |

EPS - 9 Years Ago | $0.18 |

Based on the above figures, we get the following results for each of Graham's Defensive criteria (anything above 100% is a PASS):

Sales | 998.00% |

Assets / Liabilities | 219.06% |

Assets / Debt | 10,906,200.00% |

Earnings Stability | 100.00% |

Dividend Record | 0.00% |

Earnings Growth | 199.72% |

Graham Number / Price | 108.78% |

The Graham number for Yahoo works out to $27.14. Unfortunately, Yahoo misses the Dividend Record requirement for Defensive stocks and so this is not Graham's recommended price for Yahoo.

Let's now take a look at the other grade calculations given by Graham and see if Yahoo meets them.

2. An Enterprising Analysis:

If a stock failed to meet the criteria for Defensive investment, Graham recommended the following criteria for Enterprising investment.

Summarized from CHAPTER 15 of The Intelligent Investor - Stock Selection for the Enterprising Investor:

[Note: For issues selling at P/E multipliers under 10]

1-A. Current assets at least 11⁄2 times current liabilities.

1-B. Debt not more than 110% of net current assets.

2. Earnings stability: No deficit in the last five years covered in the Stock Guide.

3. Dividend record: Some current dividend.

4. Earnings growth: Last year's earnings more than those of 1966.

[Note: This corresponds approximately to the earnings of 2008 today]

5. Price: Less than 120% net tangible assets.

This second set of criteria gives us a maximum price for a stock meeting Enterprising conditions as - the lower of 120% net tangible assets (book value), or 10 times current earnings. Again, Yahoo does not meet the Enterprising criteria for dividends so is not eligible for investment as an Enterprising stock either.

Finally, let's take a quick look at the criteria that Graham recommended for NCAV, Net-Net, or Bargain stocks; and how Yahoo fares against them.

3. An NCAV or Net-Net Analysis:

If a stock met neither Defensive nor Enterprising requirements, Graham recommended these final set of criteria.

Summarized from CHAPTER 15 of The Intelligent Investor - Stock Selection for the Enterprising Investor:

"Bargain Issues, or Net-Current-Asset Stocks"

"price less than the applicable net current assets alone - after deducting all prior claims, and counting as zero the fixed and other assets."

"eliminated those which had reported net losses in the last 12-month period."

These criteria give us what are called NCAV stocks - stocks selling for less than the value of their cash worth alone, and with positive earnings in the last one year.

These are also the most well known of Graham's stocks, and the source of the general misconception that Graham only recommended cheap stocks. These were, in fact, the last grade of stocks that Graham recommended.

Yahoo's NCAV price works out to $2.79 and the company has not reported net losses for the last 12 months. So Graham's recommended price for Yahoo remains only its NCAV price.

To Conclude

Yahoo's current price of $24.95 works out to an attractive Price/Earnings of 7.23 and a Price/Book (tangibles) of 2.63.

Unfortunately, due to the single shortcoming of not paying any dividends, Yahoo does not clear Graham's Defensive or Enterprising sets of criteria. Otherwise, the stock is exemplary in every way and would even be eligible for a Defensive price (Graham Number) investment of $27.14, even considering only its tangible book value.

Yahoo is thus perhaps a great example of why it is essential for companies to pay dividends, without which shareholders of even great stocks are left to the mercy of market fluctuations to see any timely returns on their investment.

These results are based on a strict inflation-adjusted Graham analysis. For information on how to find stocks clearing all of Graham's criteria today, see How To Build A Complete Benjamin Graham Portfolio.

Lastly, this analysis should not be construed as a recommendation to short sell Yahoo. Graham never believed in predicting a stock's future price. Yahoo may remain at its current or even higher levels indefinitely. Graham's criteria, when applied to financial data, highlight any discrepancies between stock prices and a company's underlying numbers. Such analysis simply helps in making informed investment decisions, minimizing losses, and identifying unique investment opportunities.

Disclaimer: The results were arrived at by automated quantitative analysis and were not verified manually. Verify the validity of the data used - most importantly, for any recent stock splits - before making an investment decision.

Submitted by GrahamValue. Created on Wednesday 26th June 2013. Updated on Sunday 25th December 2022.