Summary

- Warren Buffett writes that he's been exclusively following Benjamin Graham's Value Investing framework for 57 years.

- Graham recommended five investing strategies - Blue Chips, Defensive, Enterprising, NCAV, and Special Situations.

- Google qualifies under Blue Chips, but is also strongly-justifiable as a quantitatively-tested Defensive Graham stock.

Google is an American technology company that specializes in Internet-related services and products. Google was founded by Larry Page and Sergey Brin in 1998 while they were students at Stanford University, California.

Alphabet was created through a corporate restructuring of Google and became the parent company of Google and several former Google subsidiaries. Shares of Google's stock have been converted into Alphabet stock, which now trade under Google's former ticker symbols.

Benjamin Graham is known as the "father of value investing". Warren Buffett writes that he's been exclusively following Benjamin Graham's Value Investing framework for 57 years.

Previously, we discussed How To Build A Complete Benjamin Graham Portfolio.

Graham recommended five investing strategies, depending on the kind of investor one was. Blue Chips were for the most passive investors, while Special Situations were meant only for the professionals.

In this article, we'll see if Google would qualify for investment under one of these strategies.

For the most recent numbers, please see the automated analysis for Alphabet Inc (GOOG).

Financial Condition

Given below are Google's Sales and Balance Sheet figures used to verify its Financial Condition and calculate its Net Current Asset Value (NCAV/Net-Net).

- Annual Sales: $110,855.00 Million

- Current Assets: $124,308.00 Million

- Intangibles: $19,439.00 Million

- Goodwill: $16,747.00 Million

- Total Assets: $197,295.00 Million

- Current Liabilities: $24,183.00 Million

- Long Term Debt: $3,969.00 Million

- Total Liabilities: $44,793.00 Million

- Shares Outstanding: 703.60 Million

Note: Graham analyses are done exclusively with annual data.

Per Share Values

Given below are Google's BVPS, TBVPS, and EPS values used to verify its Earnings Stability and calculate its Defensive Price (Graham №).

- Book Value Per Share: $219.50

- Tangible Book Value Per Share: $191.52

- Earnings Per Share (EPS): $18.00

- EPS - 1 Year Ago: $27.85

- EPS - 2 Years Ago: $22.84

- EPS - 3 Years Ago: $20.57

- EPS - 4 Years Ago: $18.79

- EPS - 5 Years Ago: $16.16

- EPS - 6 Years Ago: $14.89

- EPS - 7 Years Ago: $13.17

- EPS - 8 Years Ago: $10.21

- EPS - 9 Years Ago: $6.66

Defensive Graham investment requires 10 years of uninterrupted positive earnings. Enterprising Graham investment requires 5 years of uninterrupted positive earnings. NCAV Graham investment requires 1 year of positive earnings.

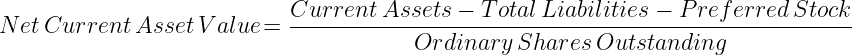

Google clears Graham's qualitative criteria for the NCAV (Net-Net) investment grade. Therefore, one of its possible Intrinsic Values is its Net Current Asset Value (NCAV / Net-Net).

((124,308 - 44,793) ÷ 703.60) = $113.01

But there are more Graham strategies to discuss.

Blue Chips

From Chapter 14 - Stock Selection for the Defensive Investor, The Intelligent Investor:

In setting up this diversified list he has a choice of two approaches, the DJIA-type of portfolio and the quantitatively-tested portfolio. In the first he acquires a true cross-section sample of the leading issues, which will include both some favored growth companies, whose shares sell at especially high multipliers, and also less popular and less expensive enterprises.

The "leading issues" or Blue Chips strategy is very specifically not quantitatively-tested, as Graham writes above. This strategy is particularly interesting to discuss, because it goes against the common perception of Graham.

The idea of "favored growth companies whose shares sell at especially high multipliers" in a Graham portfolio may seem blasphemous. But there it is, in his own words.

Graham actually recommends higher P/E multiples for Defensive investors than he does for Enterprising investors, even for his quantitatively-tested portfolios. But the idea that costlier stocks can be more Defensive is very counter-intuitive.

Google does qualify for investment under Graham's Blue Chips category (strategy #1 in the portfolio link above), being one of the biggest constituents of major indices such as the S&P 500 and the S&P 100.

Blue Chips too fall within Graham's definition of Defensive investment. But the Blue Chips sub-category does not have a specific Intrinsic Value calculation.

Defensive Investment Criteria

Graham's criteria for quantitatively-tested Defensive investment are as follows:

1. Not less than $100 million of annual sales.

2-A. Current assets should be at least twice current liabilities.

2-B. Long-term debt should not exceed the net current assets.

3. Some earnings for the common stock in each of the past ten years.

4. Uninterrupted [dividend] payments for at least the past 20 years.

5. A minimum increase of at least one-third in per-share earnings in the past ten years using three-year averages at the beginning and end.

6. Current price should not be more than 15 times average earnings of the past three years.

7. Current price should not be more than 1-1⁄2 times the book value.

As a rule of thumb we suggest that the product of the multiplier times the ratio of price to book value should not exceed 22.5.

The above rules are from Chapter 14: Stock Selection for the Defensive Investor of Graham's magnum opus, The Intelligent Investor.

Criterion #1 works out to $500 million today, based on the difference in CPI/Inflation from when the book was written in 1971.

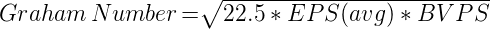

The Intrinsic Value for a Defensive stock can be calculated from the quantitative criteria (#6 and #7) for Defensive investment given above, and is popularly known as the Graham Number.

Let's see how Google's numbers stack up against the above requirements.

Final Assessment: Defensive

Google actually clears all of Graham's requirements for Defensive investment with flying colors, except one.

Google has:

- Sales/Size: 221 times that required by Graham, even adjusted for inflation.

- Current Ratio: 2.57 times that required by Graham.

- Net Current Assets ÷ Long Term Debt: 25 times that required by Graham.

- Earnings Stability: Full 10 Years as required by Graham.

- Earnings Growth: 3.9 times that required by Graham.

So if we're willing to overlook the one missing requirement — the dividends — Google is actually a stellar Defensive Graham stock.

Considering the fact that Google has an Earnings Growth 3.9 times that required by Graham — indicating that it's utilizing its retained earnings very well — this is by no means an unwarranted assumption.

Thus Google's minimum Intrinsic Value here would be its Defensive Price (Graham №): $336.28.

But there's one more adjustment to make.

Graham's Intrinsic Value formulas from actually allow for P/E ratios of 30 — or more — today based on current bond yields.

We would therefore need to multiply Google's Graham Number by 1.41, to adjust it to a P/E of 30.

30÷15 = 2

√2 = 1.41

Intrinsic Value = $336.28 x 1.41 = $474.15

Thus we get a final Graham Intrinsic Value of $474.15.

But again, one needs to also account for the fact that Google is one of today's top Blue Chips that exceeds all of Graham's requirements for Defensive investment by several multiples, especially the Earnings Growth which is nearly 4 times that required by Graham.

So Google's current price of $1,067.45 — which is 2.25 times the Intrinsic Value calculated here — is not an overvaluation even by Graham's standards.

Please note that no stock ever qualifies alone under Graham's framework. Every stock is always a constituent of a portfolio of similar stocks. Google would therefore qualify for investment as part of a diversified portfolio of Defensive and Blue Chip stocks.

What Warren Buffett Says

Submitted by GrahamValue. Created on Tuesday 24th April 2018. Updated on Monday 27th April 2020.